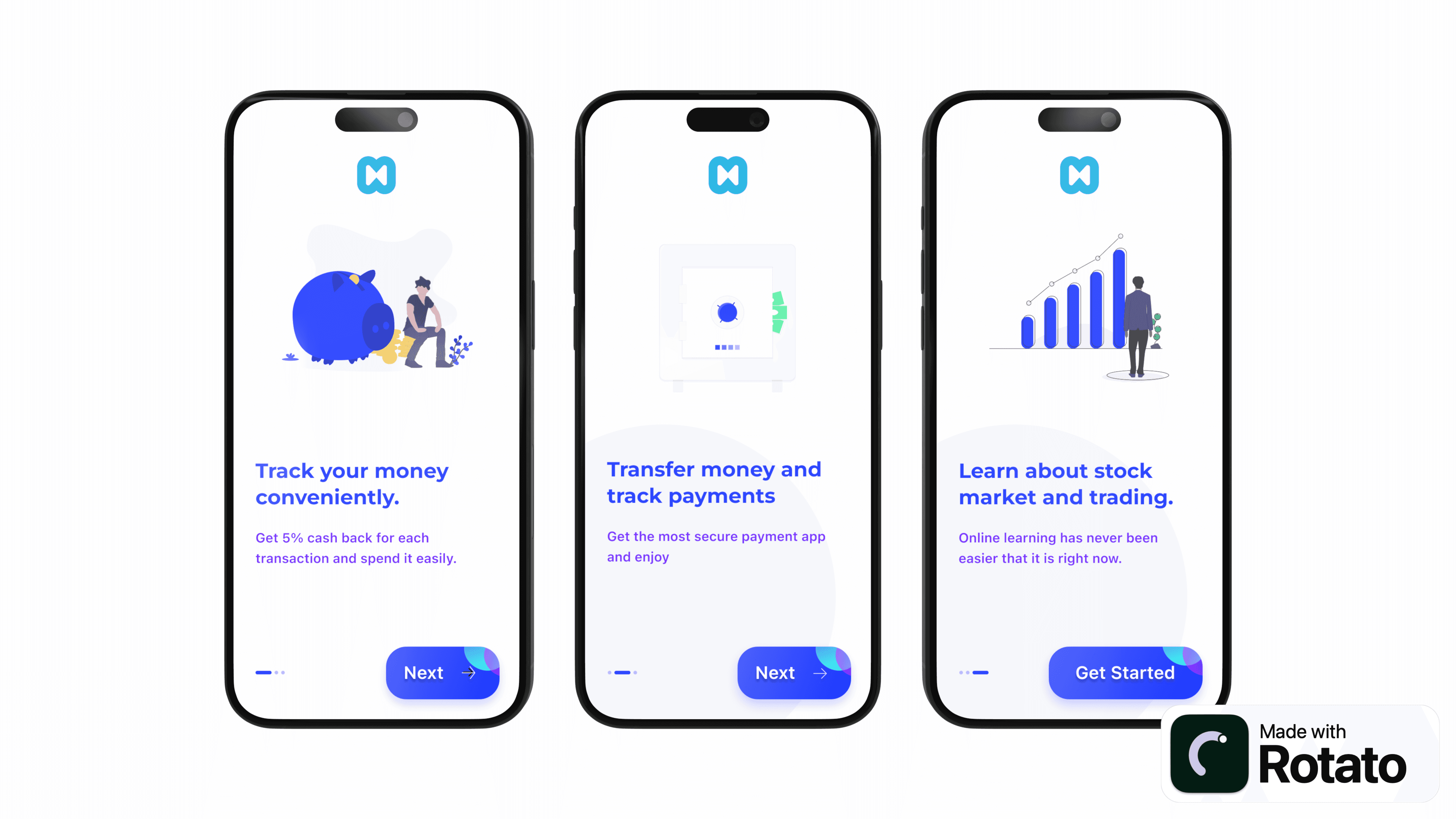

Simplify Financial Management: Provide users with an intuitive platform to manage multiple financial accounts, track expenses, and view transactions, fostering smarter money management habits.

Enhance Financial Literacy: Offer educational tutorials on stock market basics and a responsive AI chatbot to demystify investing, empowering users to make informed financial decisions.

Set and Achieve Financial Goals: Enable users to set personal financial objectives and monitor progress, encouraging disciplined and goal-oriented financial planning.

Integrated Online Payment System: Allows users to make secure payments and manage transactions across multiple cards from a single platform.

Expense Tracking and Analysis: Provides tools to monitor, categorize, and compare expenses monthly, helping users identify spending patterns and save money.

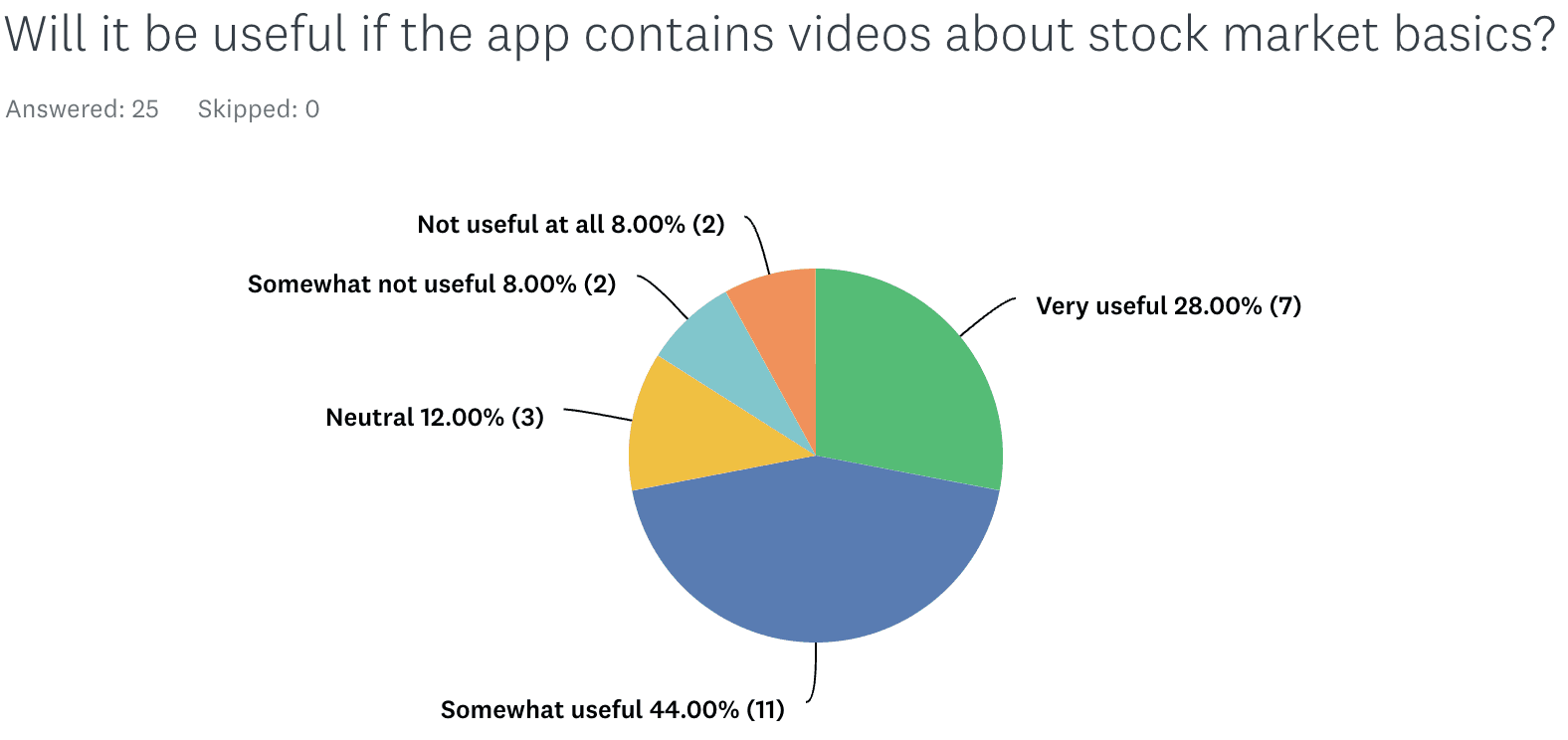

Educational Video Content: Features a library of tutorial videos on stock market basics, enabling users to enhance their investing skills and financial knowledge.

AI-Powered Financial Assistant: Includes an AI chatbot that answers queries about stock market investments and guides users through complex financial decisions.

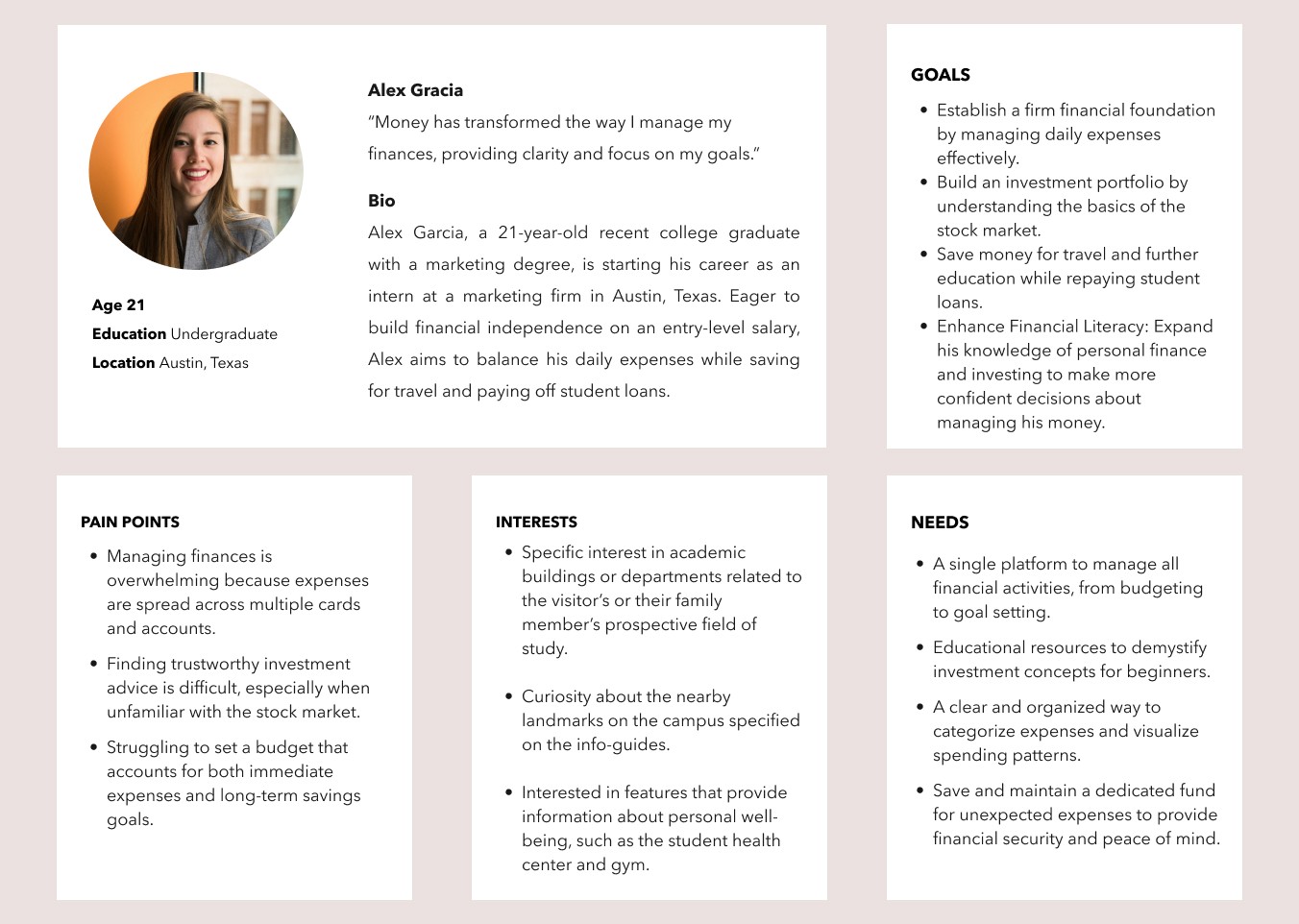

Young Professionals: Individuals in the early stages of their careers looking to establish sound financial habits and build a solid foundation for future financial security.

Financial Novices: People new to managing their own finances or investing, who seek educational resources and straightforward tools to demystify financial concepts.

Busy Multitaskers: Users who manage multiple accounts and have limited time to keep track of their financial activities, requiring efficient ways to consolidate and automate their financial management.

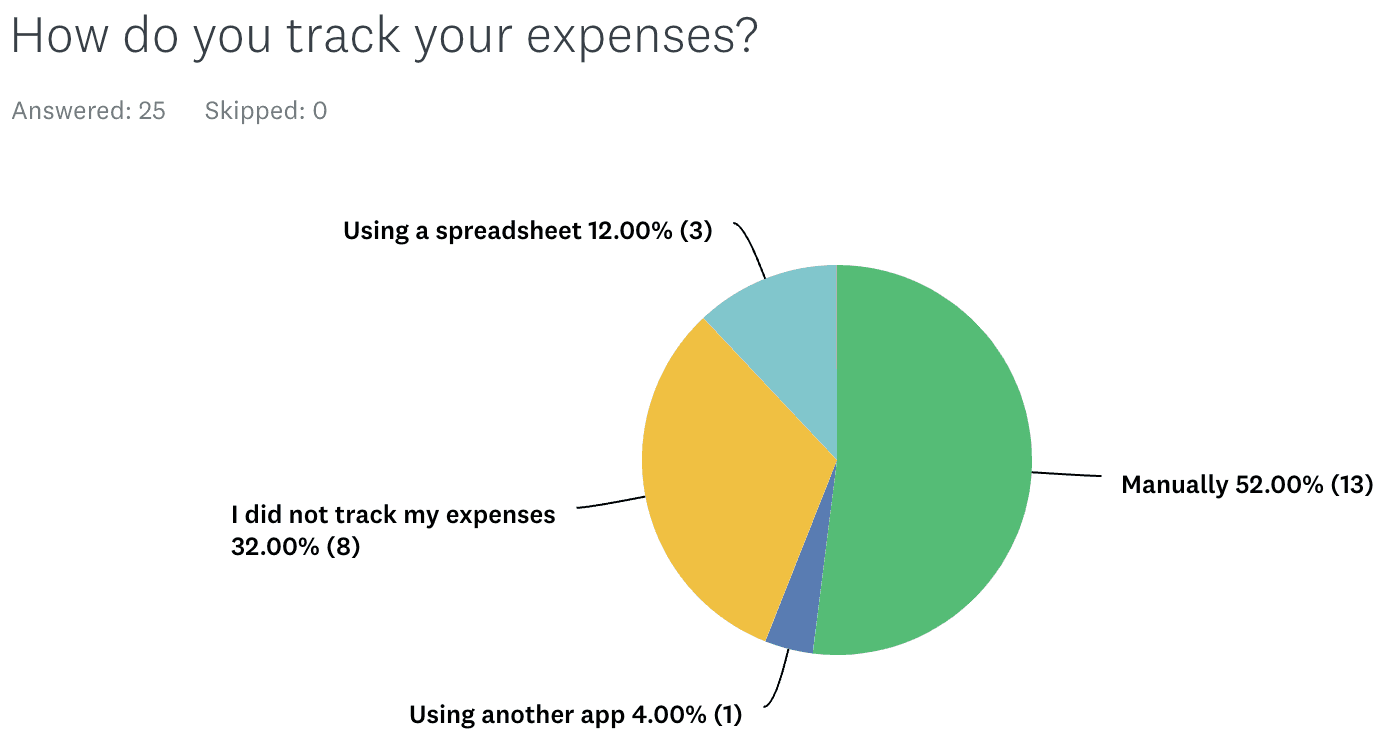

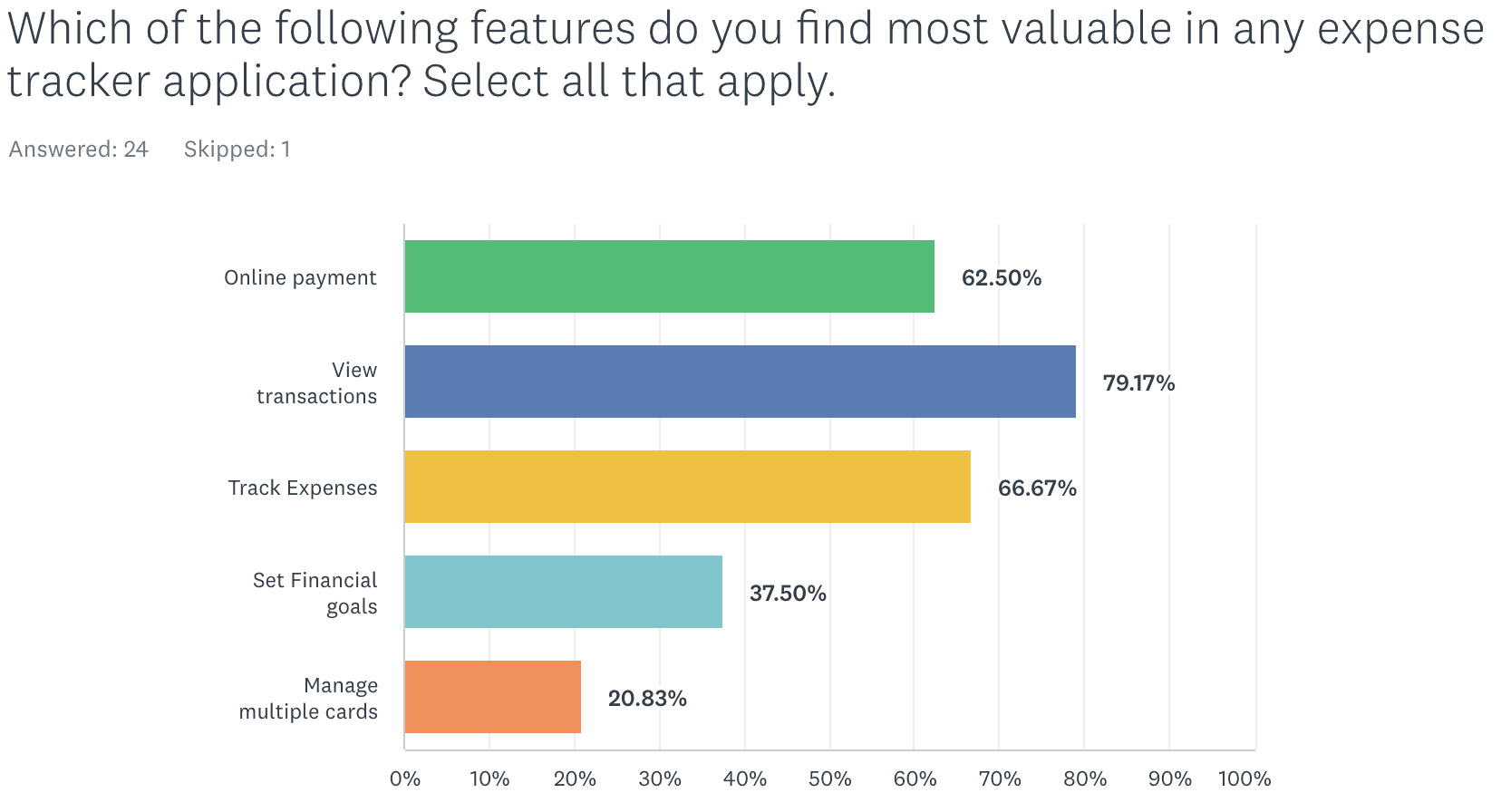

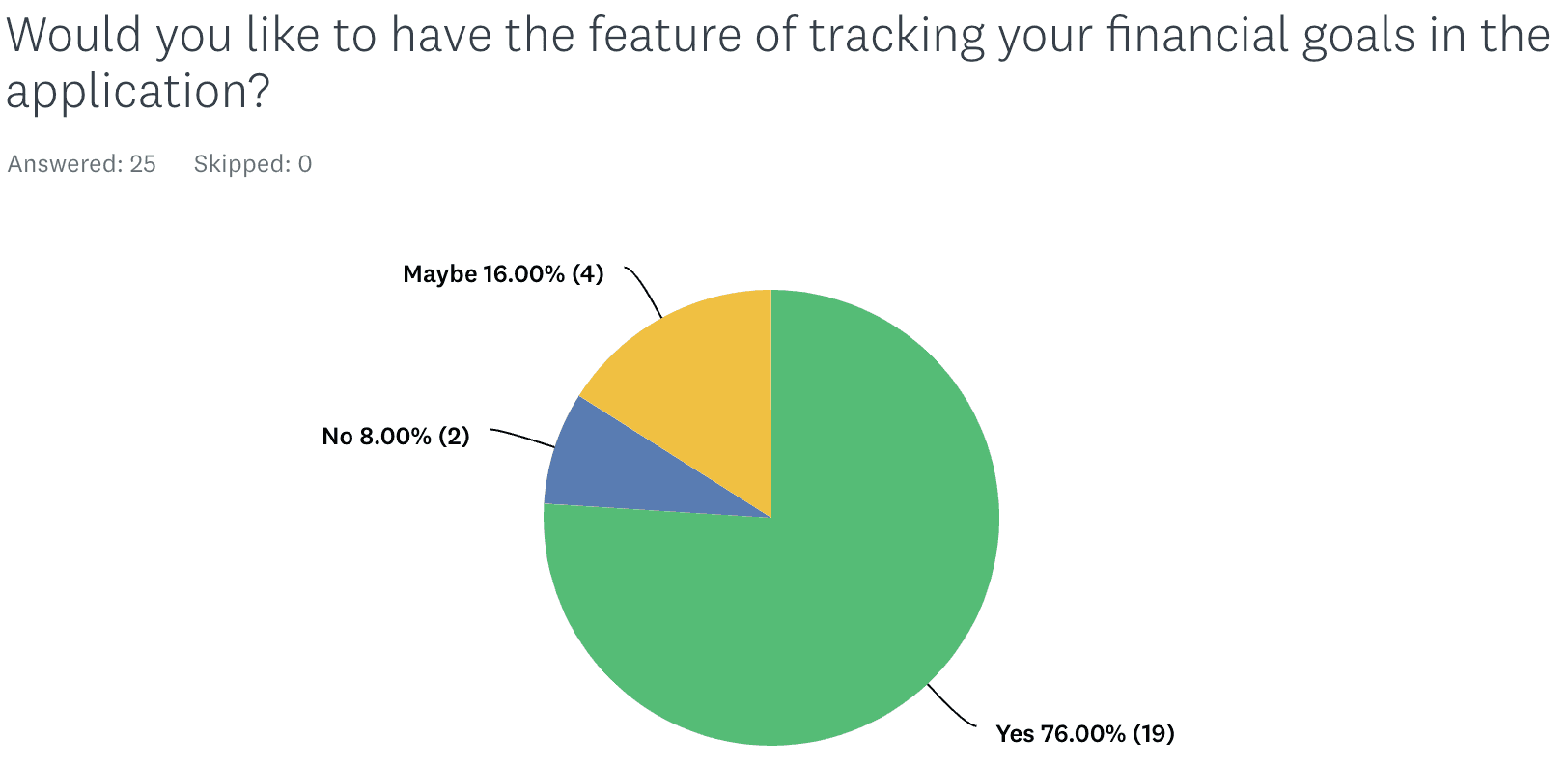

Conducted a survey for collecting data and below are the results

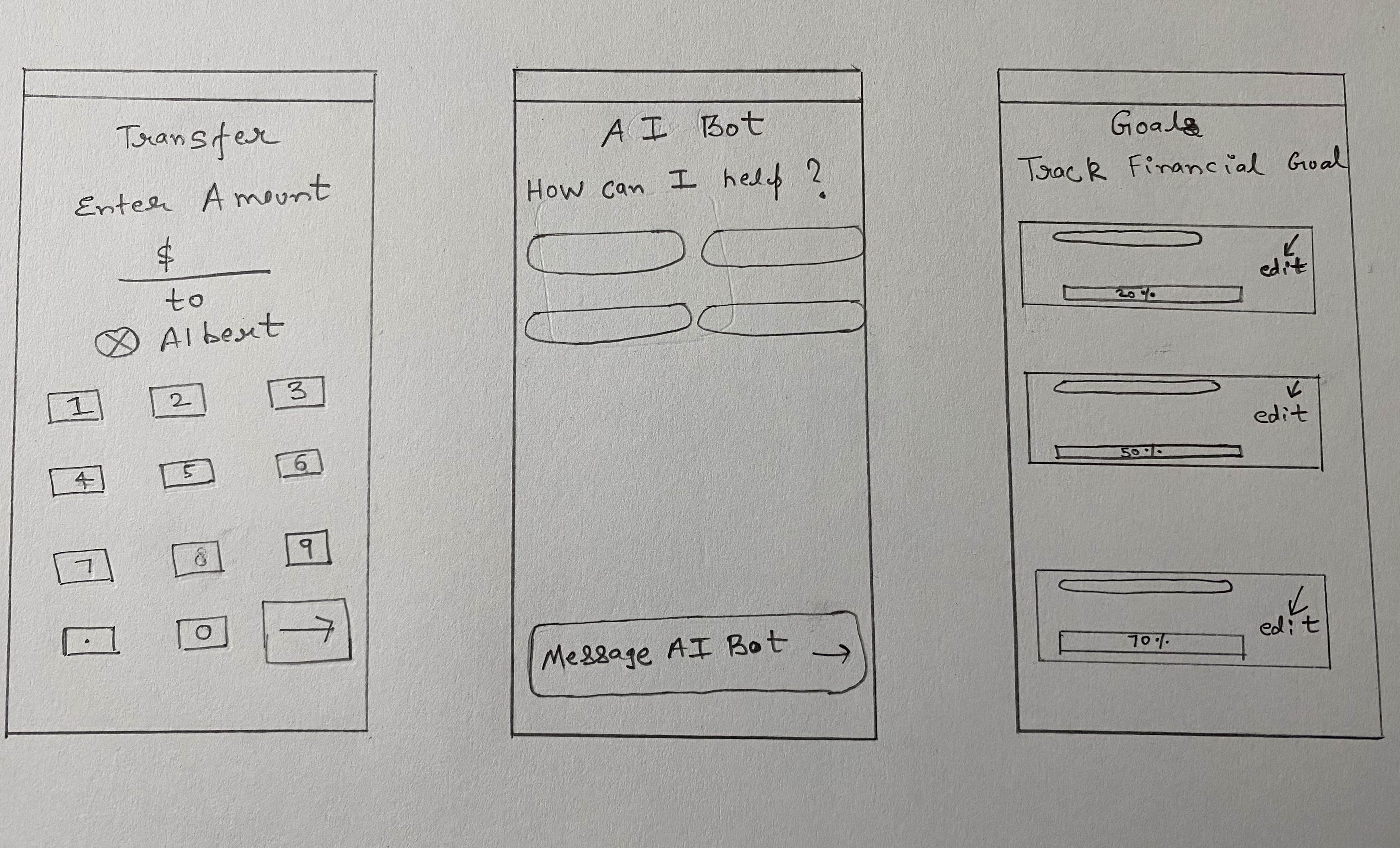

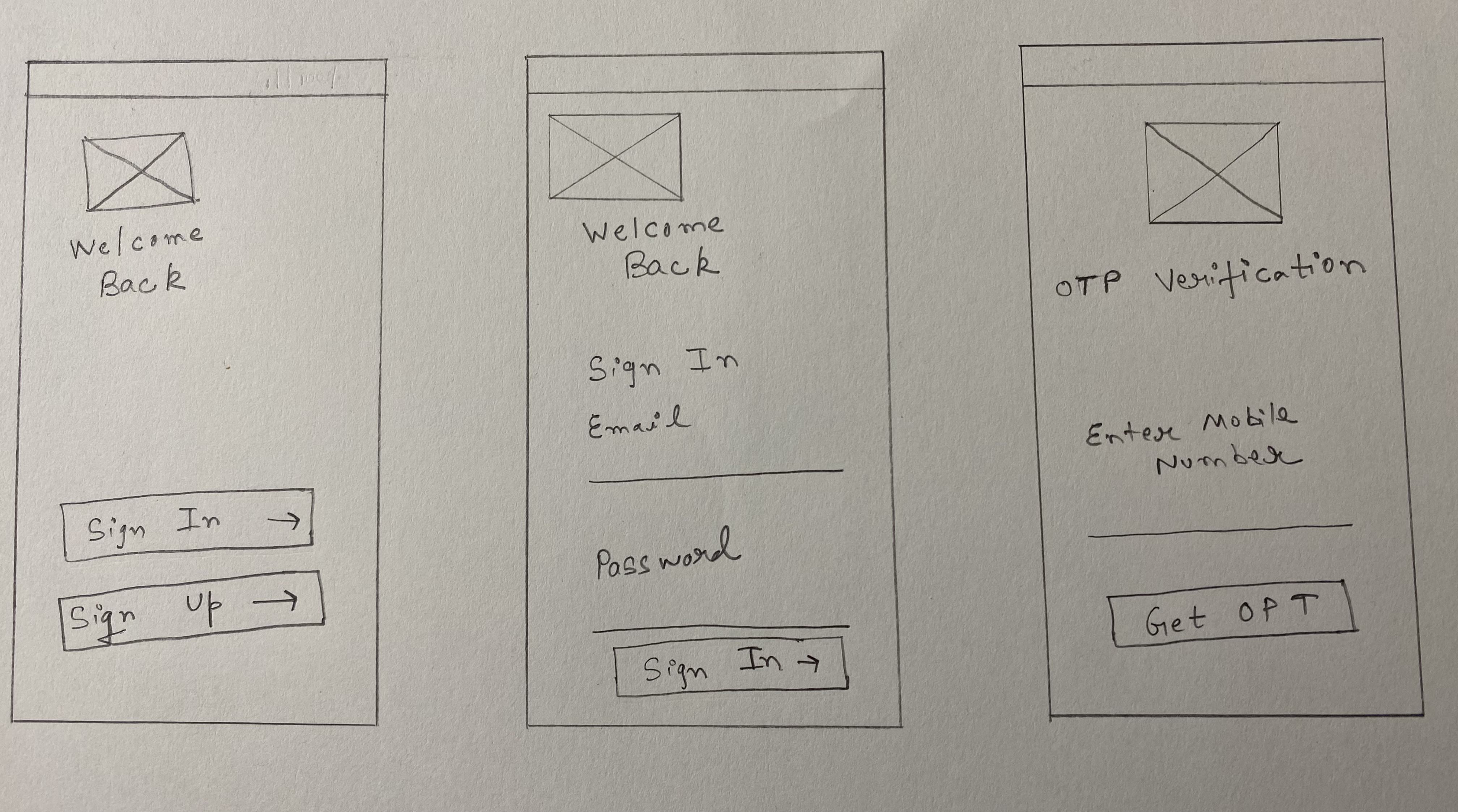

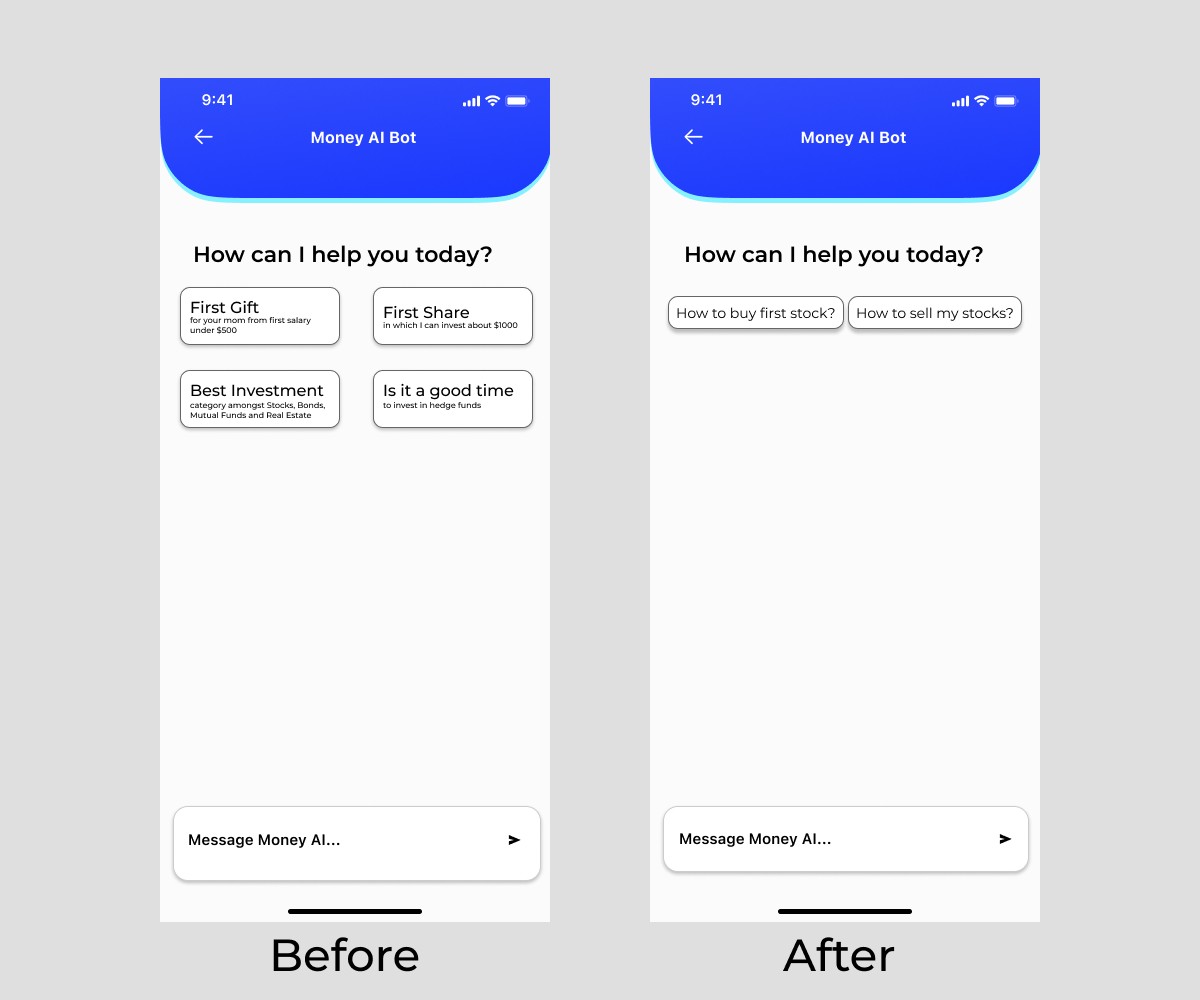

I relied on user feedback to enhance my initial designs. Several screens lacked clarity and had significant room for improvement. Below are three such examples.

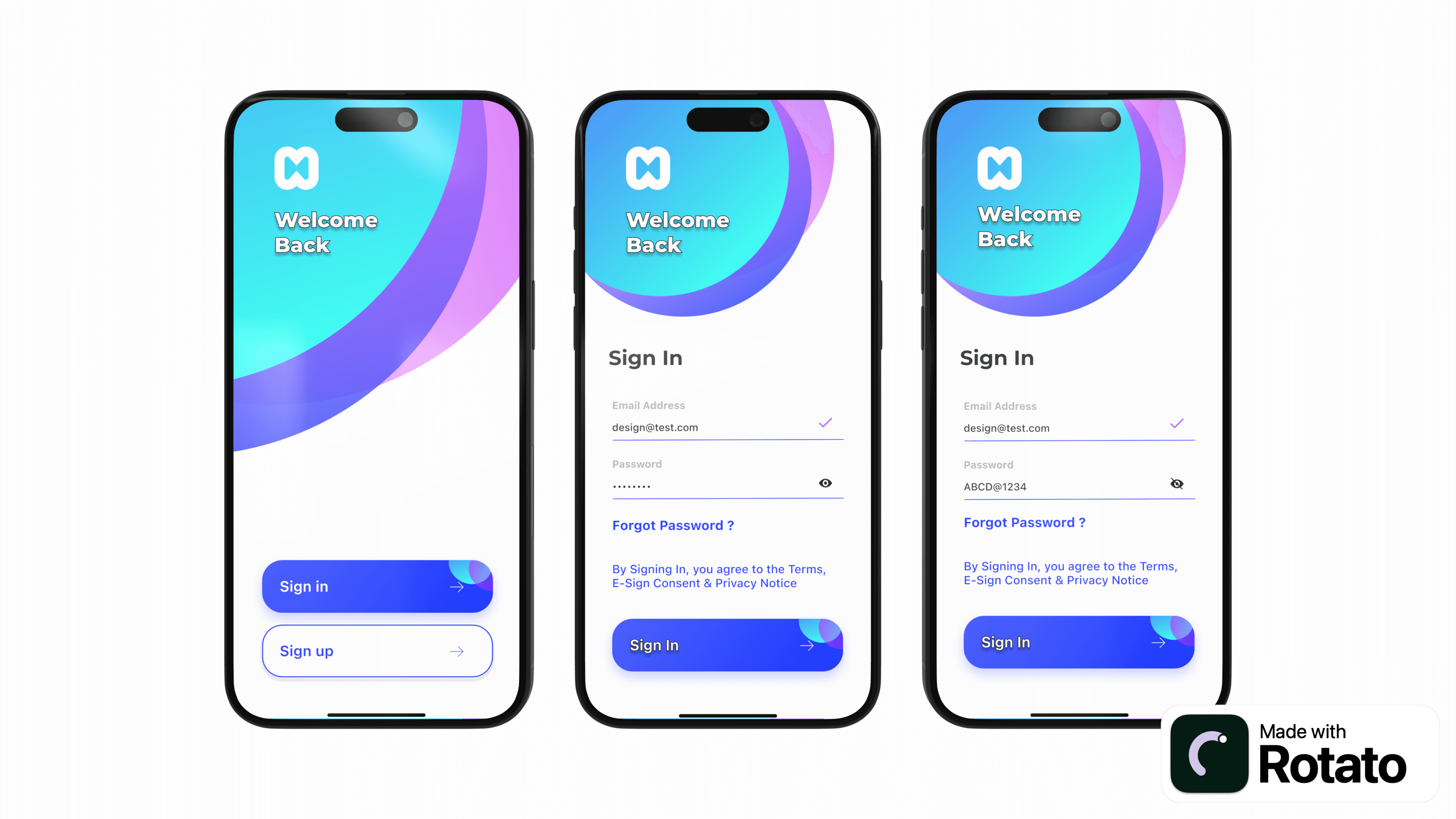

The initial design faced issues with clarity and consistency, impacting the user experience. Despite a neat layout, the interface felt unbalanced with poorly aligned interaction elements. Key improvements needed were:

Text alignment and readability

Button uniformity and responsiveness

Visual hierarchy and colour contrast

Despite a functional layout, my initial design lacked certain elements in terms of visual appeal and readability. The colours were vibrant but overwhelming, and the text didn't pop as it should, making the overall user experience less than ideal.

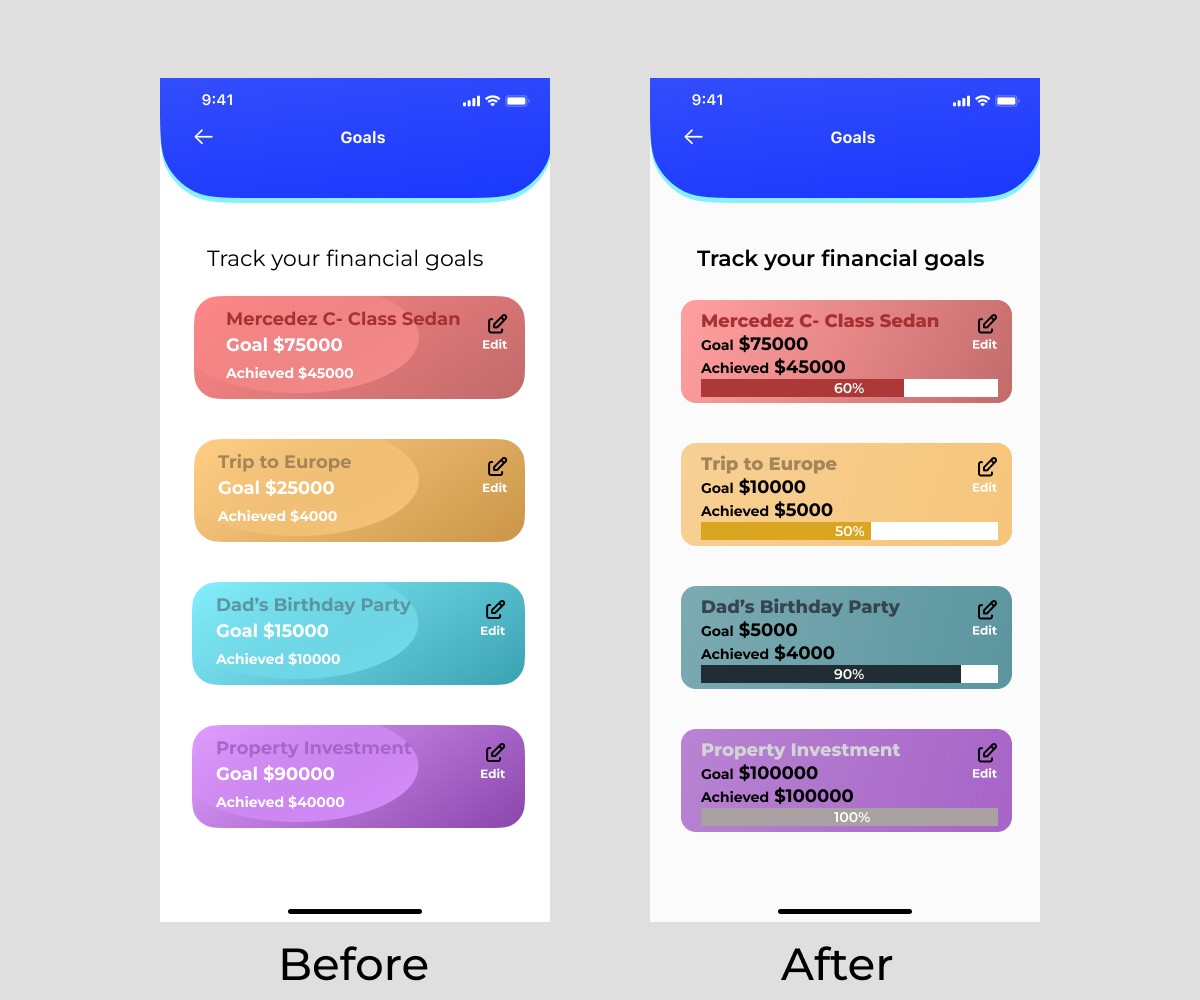

The initial UI, with its bright white background and no progress indicators, was functional yet lacked engagement and visual comfort. Feedback suggested it could be overwhelming for users, especially in low-light environments.

Welcome Screens

Sign In Screens

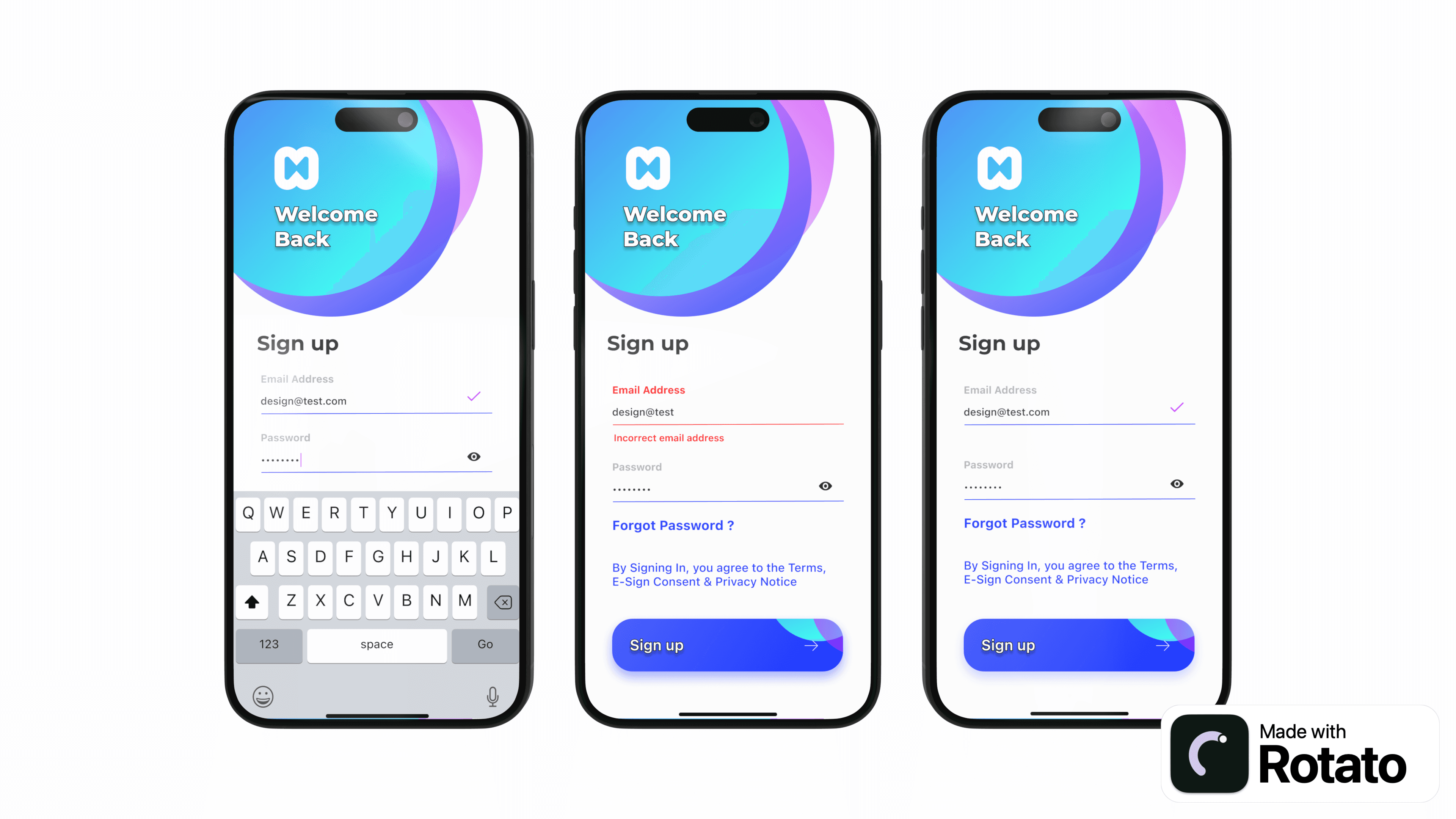

The sign-up screens ensure a smooth user experience with real-time validation and error feedback, making account creation straightforward and hassle-free.

Clear prompts and secure password handling enhance user confidence and ease of access, encouraging quick and efficient sign-ups.

Sign Up Screens

Real-time input validation ensures users receive immediate feedback, minimizing errors and streamlining the sign-up process.

Secure password handling and clear error messages enhance user confidence and ease, facilitating a smooth and efficient registration experience.

OTP Verification

The OTP verification screens provide clear instructions and input fields, ensuring a secure and straightforward user authentication process.

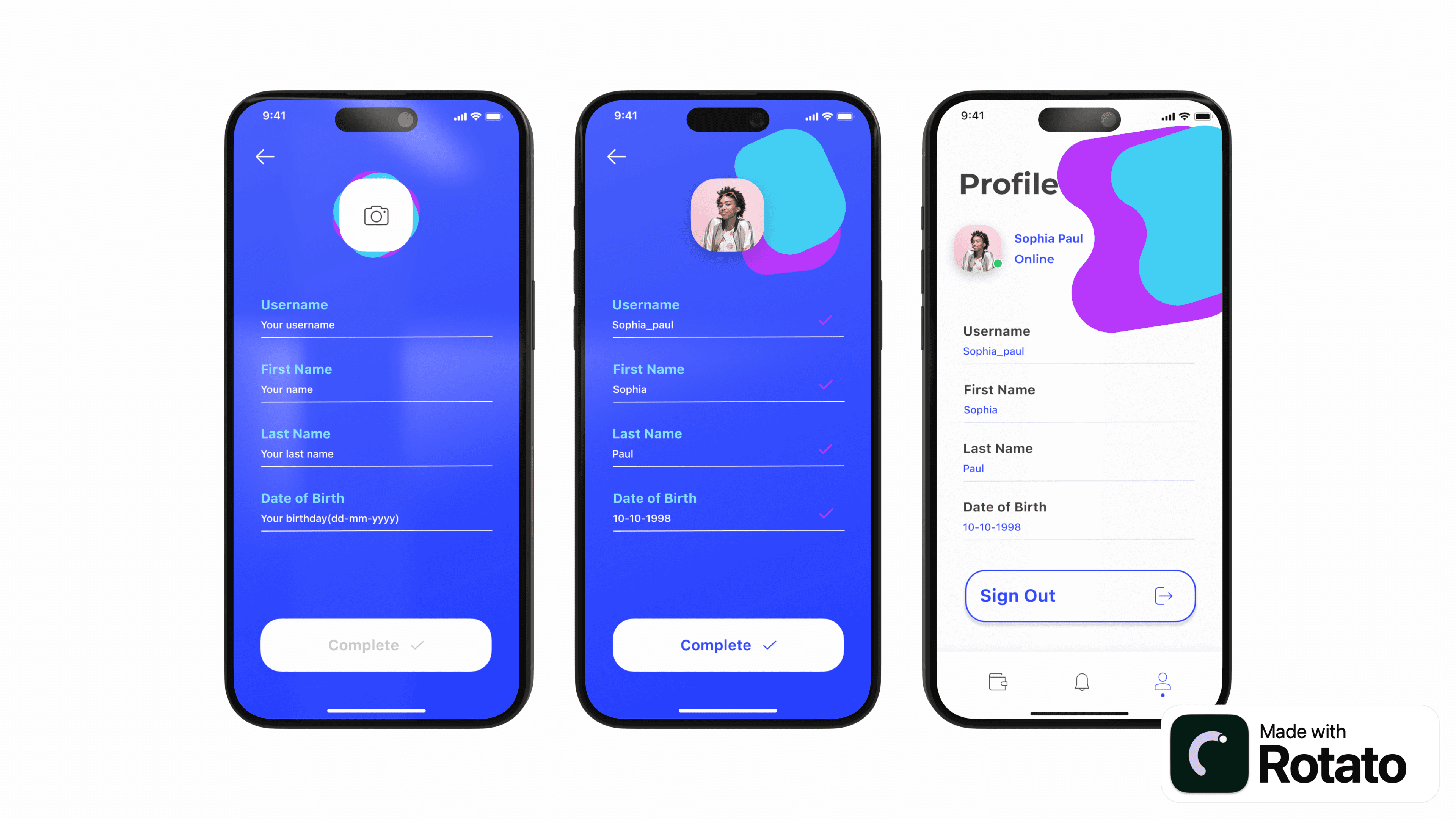

Profile Setup Screens

Provide a user-friendly interface for inputting and editing personal information, ensuring a seamless onboarding process.

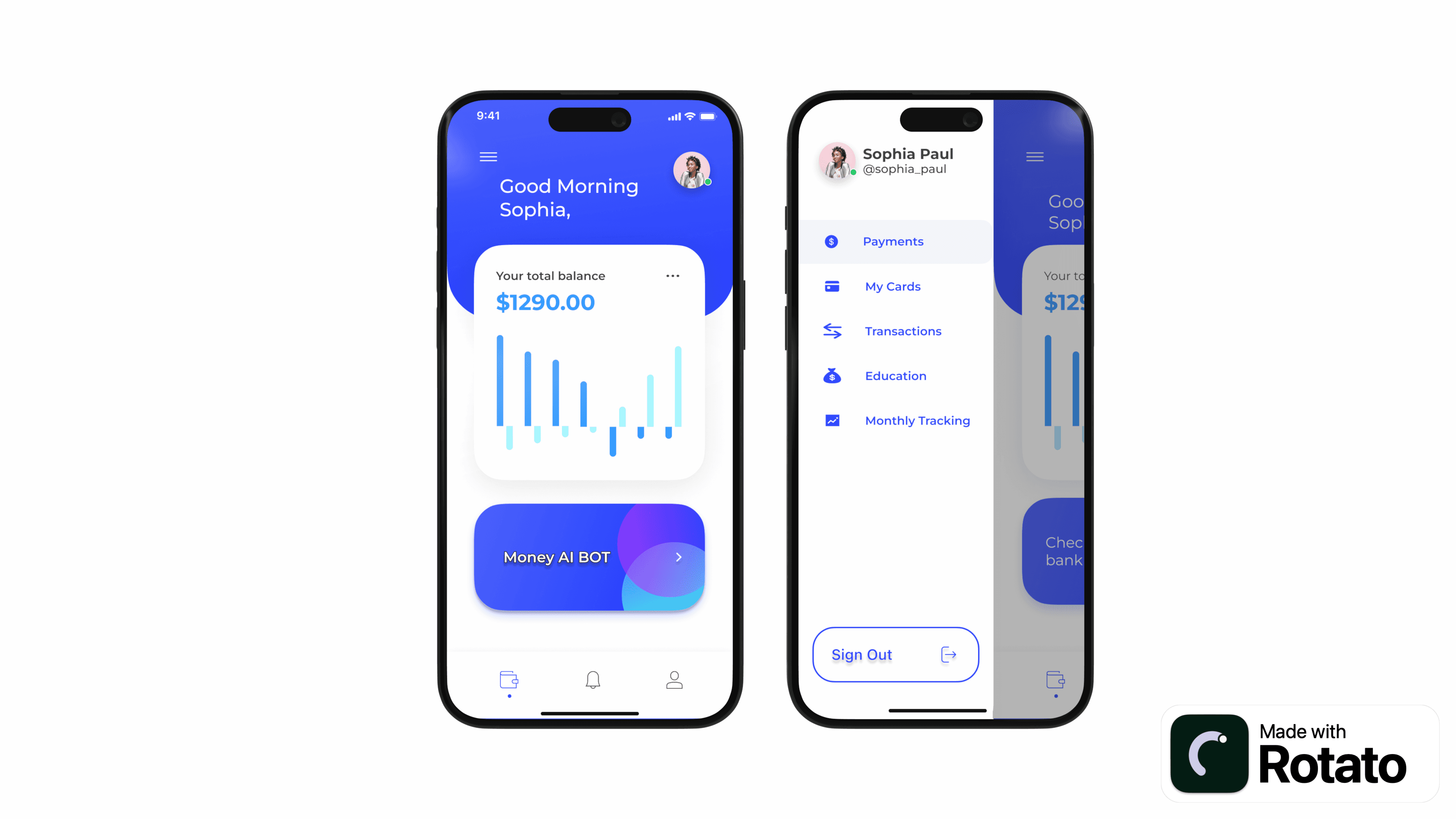

Homepage

Provides a personalized greeting and a clear overview of the user's bank balance.

Hamburger menu offers quick access to essential features like payments, card management, and transaction history, enhancing navigation and user convenience.

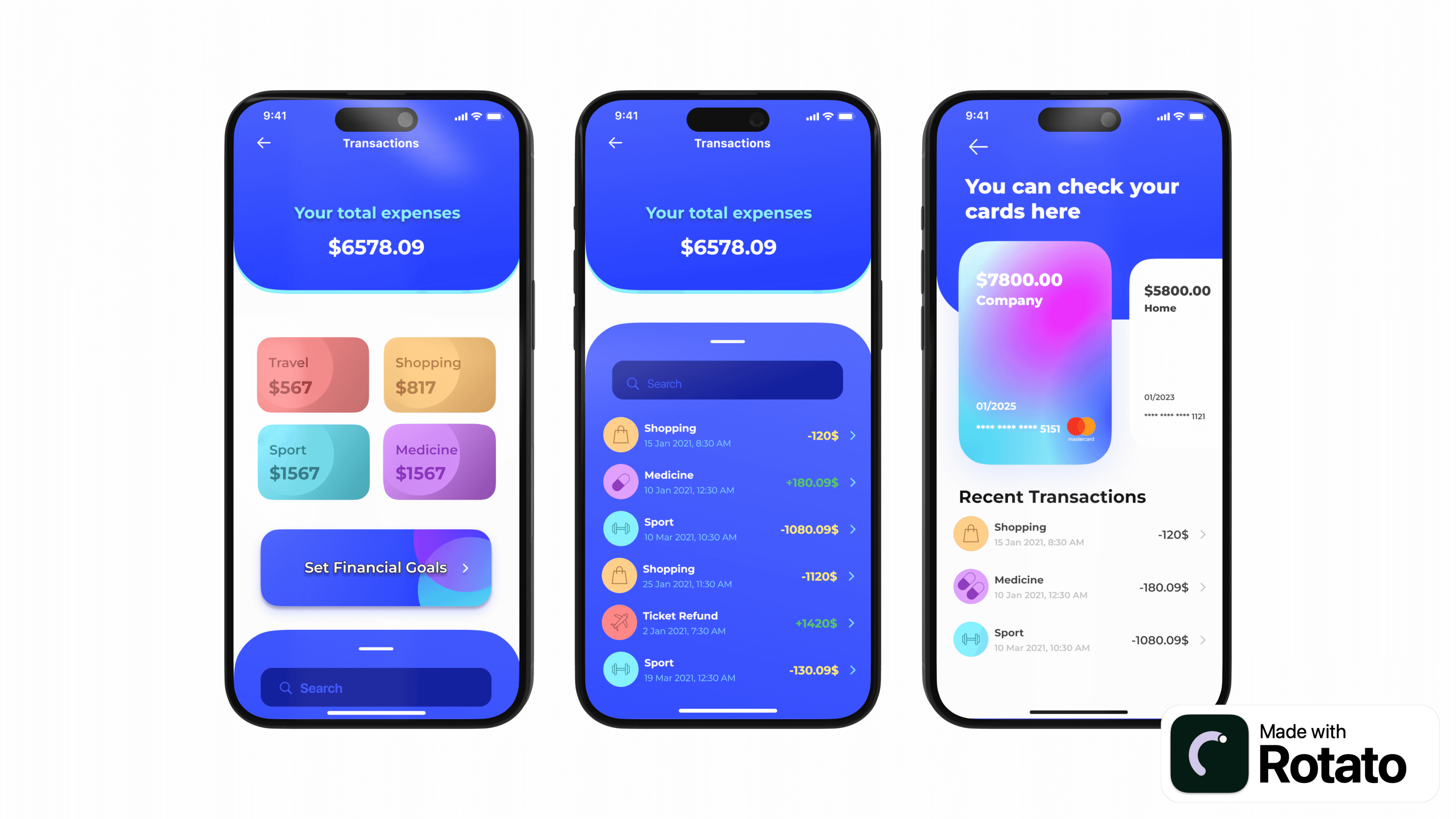

Expense Tracking

The transactions screen provides a comprehensive overview of total expenses and categorized spending, helping users easily track their financial activities and set financial goals.

The card management interface offers a clear display of multiple cards and recent transactions, enabling users to monitor their balances and transaction history efficiently.

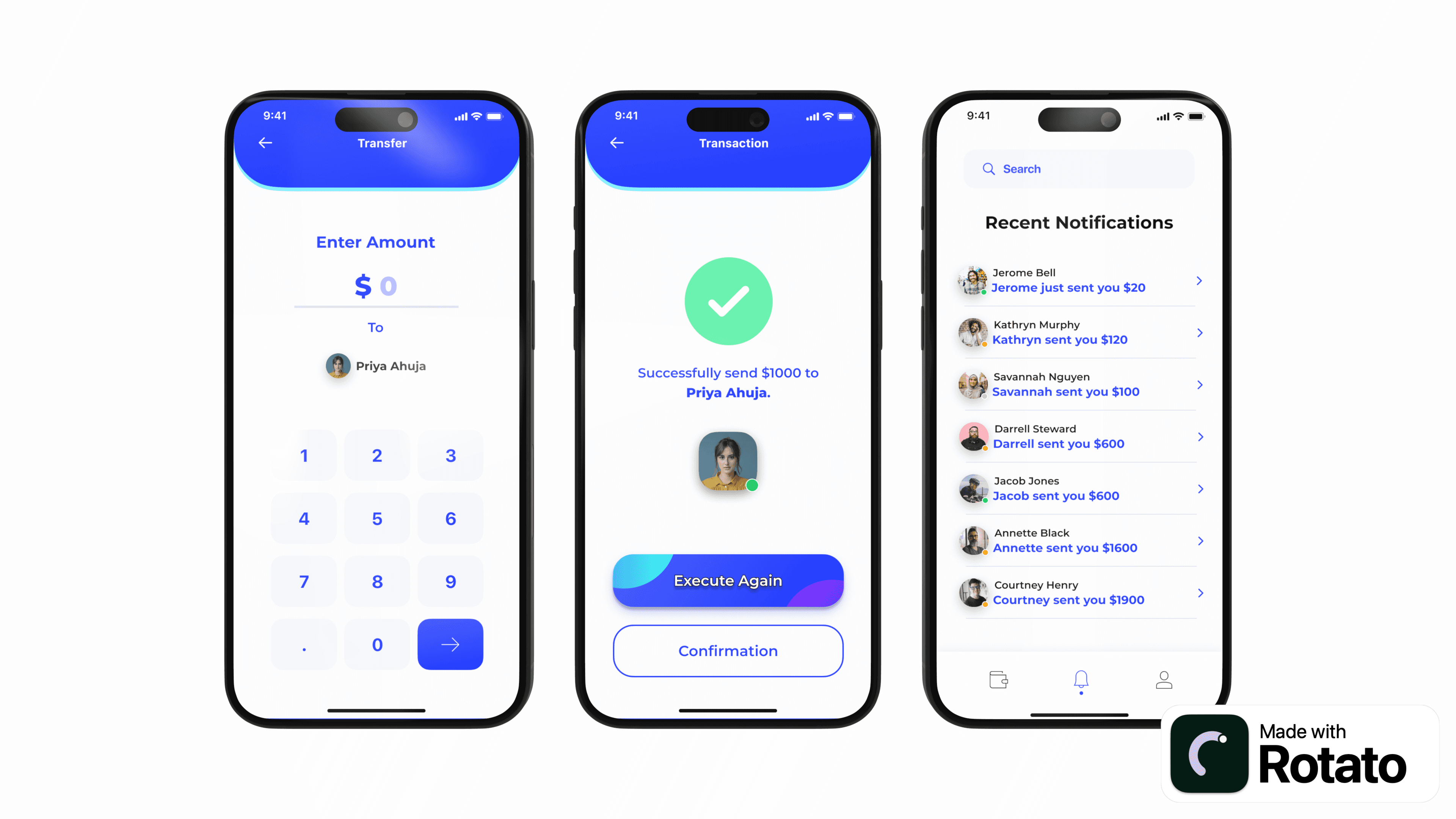

Transfer Currency

The transfer screen provides a user-friendly interface for entering transfer amounts and selecting recipients, ensuring a straightforward and efficient money transfer process.

The notification screen keeps users informed of recent transactions and updates, enhancing transparency and helping users stay on top of their financial activities.

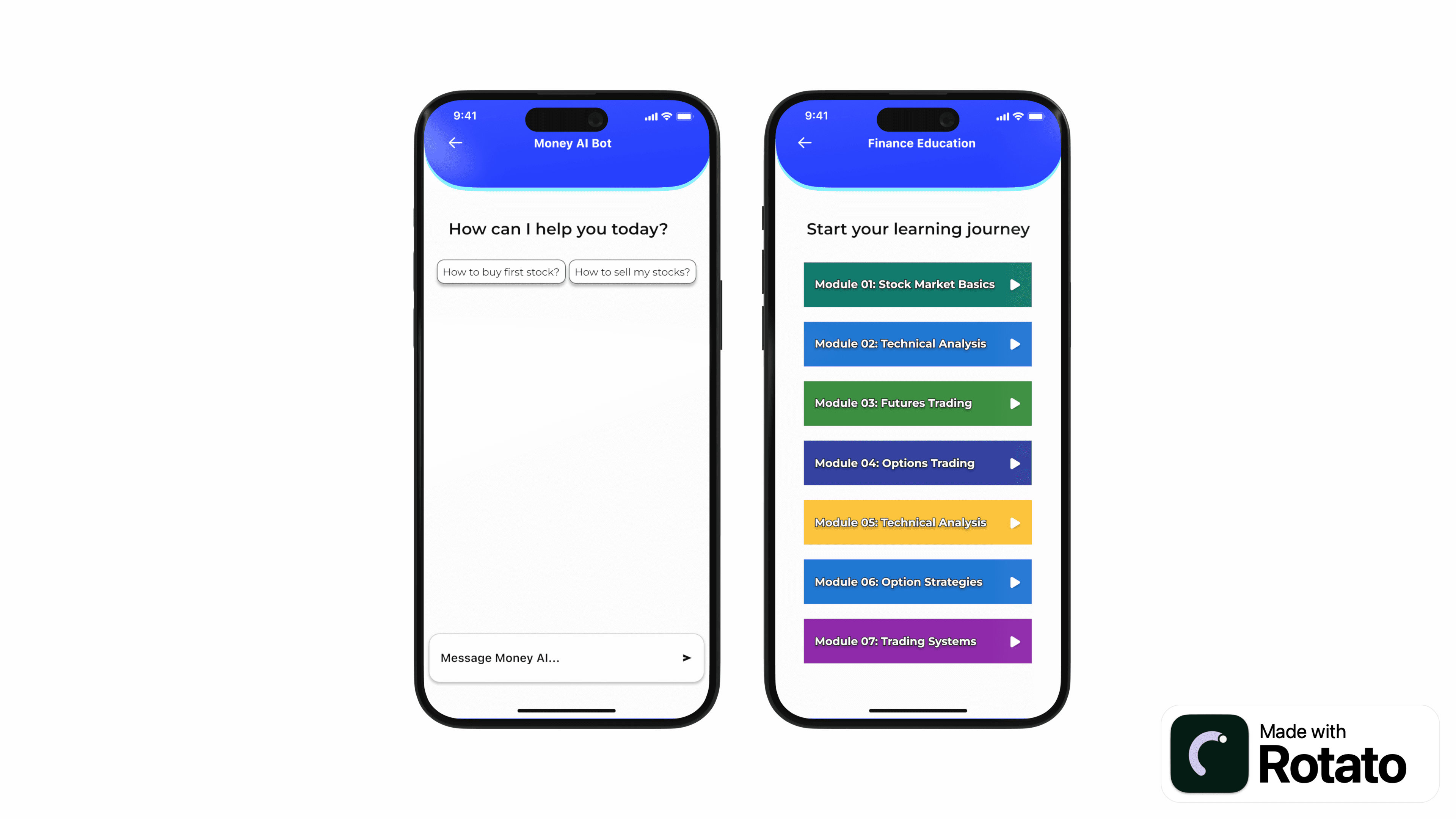

AI Bot and Learning Modules

The AI chatbot screen provides users with quick, interactive answers to common stock market questions, enhancing user engagement and support.

The finance education screen offers a structured learning journey with clearly defined modules, helping users systematically build their financial knowledge and trading skills.

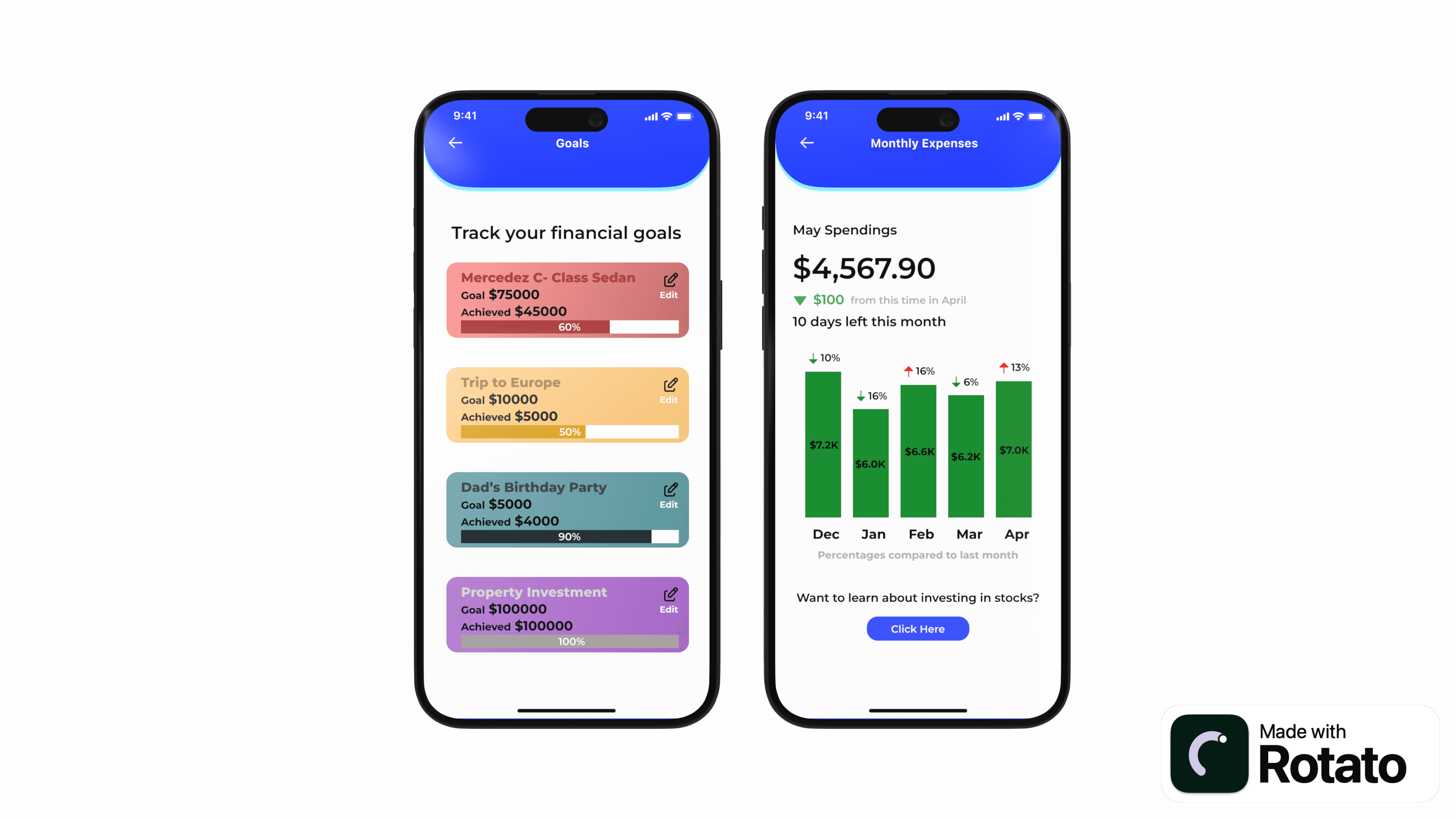

Goals and Expense Tracking

The financial goals screen allows users to track their progress towards various goals, providing clear visual indicators of achievement and remaining targets.

The monthly expenses screen offers a detailed breakdown of spending patterns, enabling users to monitor their financial health.

The Money app offers a comprehensive suite of financial management tools designed to simplify and enhance users' financial well-being. Through user-friendly interfaces and engaging onboarding experiences, the app effectively guides users in tracking their expenses, setting financial goals, and learning about the stock market. The seamless integration of features such as real-time input validation, secure authentication processes, and interactive AI support ensures a smooth and satisfying user experience. Overall, the Money app successfully meets its goal of providing users with an intuitive and efficient platform for managing their finances.

Enhanced Personalization:

Incorporate more personalized financial advice and insights based on users' spending patterns and financial goals to provide tailored recommendations.

Advanced Security Features:

Implement additional security measures such as biometric authentication and enhanced encryption to further protect users' sensitive financial data.

Cross-Platform Consistency:

Ensuring consistent design and functionality across different devices and platforms would enhance the overall user experience and accessibility.